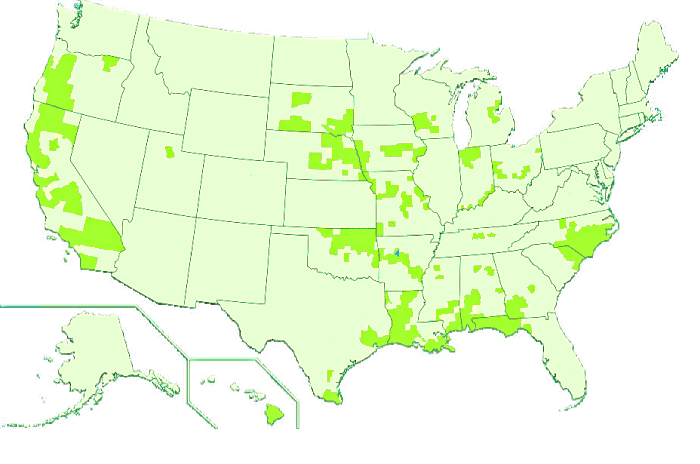

Federal Disaster

Was Your Business Affected by a Federal Disaster?

WHAT IS THE DISASTER RELIEF EMPLOYEE RETENTION CREDIT (ERC)?

- This credit is worth up to $2,400 per qualified employee and offsets your business’s federal income tax liability.

- Eligible businesses qualify for continuing to pay their employees during the time-frame that the business was impacted by the disaster.

- The credit allows qualified wages paid up to 150 days after the end of the disaster incident date.

- Eligible Businesses are those with a principal address or worksite location in one of the affected disaster counties, impacted adversely by the disaster, and retained employees during the impact period.

Core Services

- Comprehensive Health Benefits Administration

- Plan Brokerage: Medical, Dental & Vision

- Open Enrollment Management

- Employee Onboarding & Offboarding

- COBRA Administration

Features

- ACA & COBRA Compliance

- Integration with Payroll & Other Benefits

- Plans through United Healthcare, Florida Blue and Anthem

- Small, Mid-Size & Enterprise Companies Detailed Quarterly Reporting